Business

Guardians of Stability: Exploring Secured Business Loans

Secured business loans are vital for entrepreneurs looking to stabilise or expand their operations. These financial instruments not only provide necessary capital but also offer terms that can be more favourable than their unsecured counterparts. In this article, we delve into the nature of secured business loans, their benefits, and the considerations businesses must consider when pursuing this type of financing.

Understanding Secured Business Loans

What are Secured Business Loans?

Secured business loans are types of loans that require the borrower to offer an asset as collateral. This collateral could be real estate, equipment, inventory, or other valuable business assets. The fundamental premise is that the loan is “secured” against the value of these assets. If the borrower cannot repay the loan, the lender has the right to seize the collateral to recover the loaned amount.

How Do They Differ from Unsecured Loans?

Unlike unsecured loans, which are based on the borrower’s creditworthiness and do not require collateral, secured loans are backed by physical assets. This difference fundamentally affects the risk associated with the loan from the lender’s perspective. Consequently, secured loans typically have lower interest rates than unsecured loans, reflecting the lower risk of financial loss for the lender.

Advantages of Secured Business Loans

Lower Interest Rates

One of the most appealing aspects of secured business loans is their relatively lower interest rate. Since the loan is backed by collateral, lenders are usually willing to offer more competitive rates. This can significantly reduce the overall cost of the loan for the borrower, making significant capital investments more feasible.

Higher Borrowing Limits

With collateral backing the loan, lenders are often more comfortable offering more significant amounts. This is particularly beneficial for businesses that need substantial funds to invest in property, plant, or equipment or expand operations. Higher borrowing limits can give businesses the necessary resources to scale effectively and efficiently.

Longer Repayment Terms

Secured business loans often have more extended repayment periods. This can be advantageous for businesses that need time to generate investment returns before they can start repaying the loan. Longer terms can also help manage cash flow more effectively, as payments are spread out over a more extended period.

Key Considerations When Opting for a Secured Business Loan

Risk of Losing Collateral

The most significant risk associated with secured business loans is the potential loss of collateral. Businesses must be confident in their repayment capabilities before securing assets against a loan. Failure to repay the loan can result in the seizure of assets, which can be detrimental to the business’s operational capacity and overall health.

Requirement for Valuable Assets

To qualify for a secured loan, a business must possess assets that can be valued and accepted as collateral. Startups or companies without significant tangible assets may find it challenging to secure such loans. Businesses must assess their asset portfolio and understand its suitability for securing a loan.

Impact on Credit Scores

Like any form of credit, secured business loans can impact a business’s credit score. Timely repayment can enhance a business’s creditworthiness, potentially leading to more favourable borrowing terms in the future. Conversely, missed or late payments can negatively affect the credit score.

Navigating the Process of Secured Business Loans

Assessment of Needs and Capabilities

Before pursuing a secured business loan, businesses must thoroughly assess their capital needs and repayment capabilities. This involves careful financial forecasting and risk assessment to ensure the business can handle the loan terms without jeopardising its economic stability.

Choosing the Right Lender

Choosing the right lender is crucial. Businesses should look for lenders who offer transparency in rates, fees, and loan terms. It’s also advisable to consult with financial advisors or loan brokers who can offer insights and assist in comparing different loan options.

Legal and Financial Consultation

Understanding the legal implications of entering into a loan agreement is paramount. Businesses should seek legal counsel to thoroughly understand the terms and conditions of the loan. Additionally, financial advice can be invaluable in structuring the loan sustainably for the business.

Conclusion

Secured business loans are powerful financial tools to stabilise and fuel business growth. By offering lower interest rates, higher borrowing limits, and longer repayment terms, these loans are desirable for businesses looking to make significant investments. However, the advantages come with risks, primarily the loss of collateral. Companies must approach secured business loans with a clear understanding of their financial situation and strategic goals to make the most of the opportunities these loans offer while safeguarding their assets and future.

Business

The Benefits of Choosing Spiral Bound Booklets for Your Projects

Key Takeaways

- Spiral-bound booklets offer versatility and durability.

- They are ideal for various uses, such as presentations, manuals, and portfolios.

- Understanding the process of creating spiral-bound booklets can help you make choices for your needs.

Why Choose Spiral Bound Booklets?

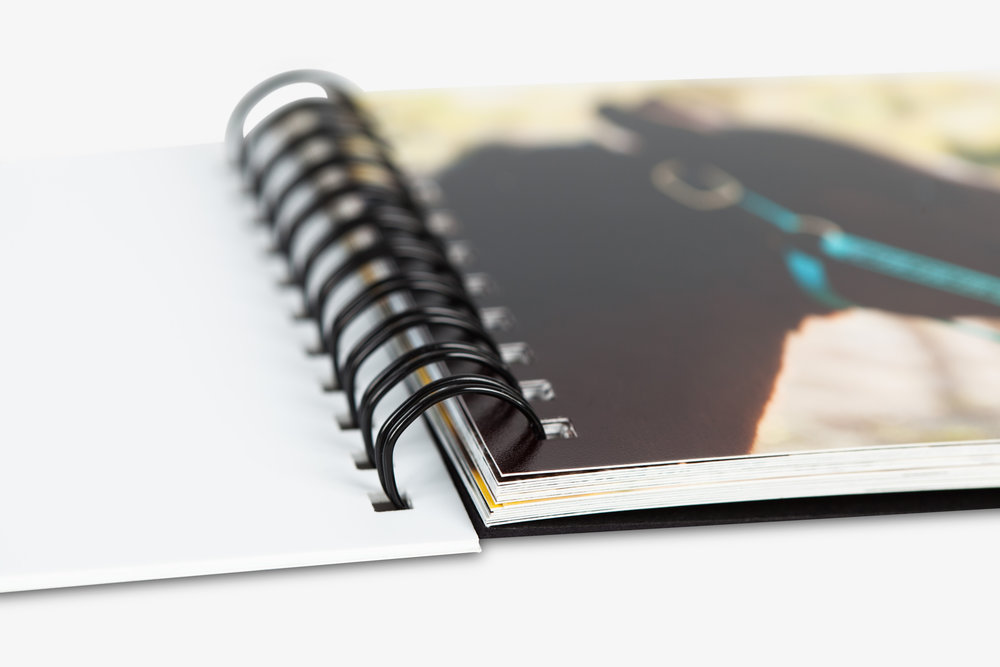

Spiral-bound booklets have become increasingly popular due to their practicality and versatility. Unlike other book binding methods, the spiral binding technique allows booklets to lay flat and open 360 degrees. This makes them great for various uses, from business presentations to academic projects. Additionally, if you are looking for spiral bound book printing for your next project, ensuring a high-quality finish is essential.

One of the standout features of spiral-bound booklets is their ability to lay completely flat when opened. This characteristic benefits instructional manuals and cookbooks, which users must follow hands-free. Spiral-bound booklets are among the most durable and long-lasting options available for printed materials. The spiral binding structure supports the pages, ensuring they remain intact even with frequent use, making them ideal for academic and professional settings.

Versatility and Applications

One of the main advantages of spiral-bound booklets is their versatility. They can be used for presentations, training manuals, cookbooks, portfolios, etc. For instance, many companies prefer them for creating professional handouts and reports because they are easy to handle and read. This makes them ideal for large-scale business events and more minor, more personal uses. In educational settings, spiral-bound booklets are often the go-to choice for distributing course materials, enabling students to flip through pages quickly without damaging the book.

The adaptability of spiral-bound booklets also extends to the creative industries. Artists and photographers frequently use them to create portfolios. The flexibility in size and design ensures that their work is presented in the best possible light. Additionally, small business owners often use these booklets for product catalogs, thanks to their user-friendly format, which helps in better customer engagement.

Durability and Professionalism

Regarding durability, spiral-bound booklets take a lot of work to beat. The spiral binding ensures that pages stay intact despite frequent handling, making them suitable for documents that need to endure constant use. Additionally, they lend a touch of professionalism that is often required in business settings. High-quality spiral-bound booklets not only look good but also make a lasting impression.

The reinforced spine provided by spiral binding adds another layer of durability. This means the booklets can endure rough handling, making them ideal for training manuals and educational resources that frequently use them. As highlighted in a study, such durability and professional appearance are why many educators and corporate trainers opt for spiral-bound booklets. They offer both practicality and a polished look, setting the tone for any material contained within.

Design and Customization

The customization possibilities for spiral-bound booklets are virtually endless. You can choose from various cover materials, colors, and sizes to match your needs. Whether you’re looking for a minimalist design or something more elaborate, spiral-bound booklets can be tailored to your preferences. Customization makes aligning the booklet’s design with your brand identity or personal aesthetic accessible.

For businesses, customized spiral-bound booklets can serve as an extension of your brand. Printing your company logo on the cover or using brand colors ensures that your marketing materials are cohesive and professional. Similarly, educators can design custom covers and layouts that align with their course themes, making the booklets more engaging for students. The ability to customize every aspect of the brochure means it can be as unique as its content.

Cost-effectiveness

Spiral-bound booklets are not only practical but also cost-effective. Compared to other binding methods, the production costs are generally lower while providing a high-quality finish. This makes them an excellent option for both small businesses and large corporations. The affordability of creating spiral-bound booklets keeps their quality high, making them a preferred choice for various professional uses.

The cost-effectiveness of spiral-bound booklets is particularly advantageous for bulk orders. Whether printing multiple copies for a large-scale event or producing training manuals for a new batch of employees, the lower production costs per unit can lead to significant savings. This makes spiral-bound booklets a budget-friendly option for organizations of all sizes.

How to Create Your Own Spiral Bound Booklet

Creating your spiral-bound booklet is easier than you think. Here are the steps you can follow:

- Determine the purpose and audience of your booklet.

- Choose the appropriate size and materials based on the intended use. For example, a brochure meant for a corporate presentation might require a more professional finish than one made for personal use.

- Design your content, ensuring it is well-organized and visually appealing. Use layout tools and templates to streamline the design process.

- Select a reputable printing service to produce your booklet. Ensure the service offers customization options that meet your specific needs.

- Review the proof and make any necessary adjustments before final printing. This step is crucial to ensure the final product is error-free and matches your vision.

Final Thoughts

Spiral-bound booklets are an excellent choice for a variety of projects. Their versatility, durability, affordability, and potential for customization make them a top choice for many professionals. By understanding the benefits and the process of creating spiral-bound booklets, you can make informed decisions that will enhance the quality of your printed materials.

From business presentations and training manuals to creative portfolios and personal projects, spiral-bound booklets offer a reliable and stylish way to present your content. Their ability to combine practicality with professionalism makes them a versatile tool well-suited to various applications.

Business

Top 5 Advantages Of Roll Stock Packaging

Roll stock packaging is a versatile and efficient solution that offers numerous benefits for brands looking to enhance their packaging strategies. At ePac, we specialize in providing flexible packaging solutions that cater to a wide range of industries. Here are the top five advantages of choosing roll stock packaging for your products:

Material Options

One of the key advantages of roll stock packaging is its flexibility in material options. At ePac, we offer a variety of films and laminates that can be customized to meet your specific packaging needs. Whether you require high-barrier films for perishable goods, eco-friendly options for sustainable packaging initiatives, or specialty films for unique product requirements, our rollstock packaging solutions ensure that your products are not only well-protected but also presented in a way that enhances shelf appeal and consumer perception.

Working With A Co-Packager

Partnering with a skilled co-packer can streamline your production processes and improve overall efficiency. ePac collaborates closely with brands to integrate roll stock packaging seamlessly into their operations. Whether you’re a startup looking to scale up production or an established brand seeking to optimize supply chain logistics, our expertise in flexible packaging solutions ensures that your products are packaged consistently and delivered to market with reliability and quality. Explore how our solutions, such as custom coffee bags or stick pack packaging, can elevate your brand’s packaging strategy and meet consumer demands effectively.

Business

Why Florida Drivers Should Prioritize Windshield Repair Florida

Windshield Repair Florida

Florida’s climate is known for its beautiful beaches and sunny skies, but it also poses unique challenges for vehicle owners. One of the most pressing issues? Windshield damage Repair Florida. From intense UV rays to sudden rainstorms, Florida’s weather can wreak havoc on your car’s glass.

In this blog post, we will explore the science behind windshield damage, the benefits of prompt repairs, and how you can choose the right service for your needs. We’ll also provide practical tips for preventing future damage, ensuring you stay safe on the road.

The Science Behind Windshield Damage

Florida’s weather is a double-edged sword; while it allows for year-round driving, it also subjects vehicles to conditions that can lead to windshield damage.

Florida’s Weather and Its Impact on Windshields

One of the main challenges for Florida drivers is the intense sunlight. UV rays can weaken the resin that holds your windshield together, making it more susceptible to cracks. This is especially true during the summer months when temperatures soar.

Additionally, Florida is notorious for its sudden storms. A clear day can quickly turn into a torrential downpour, causing rapid temperature changes that stress the glass. These fluctuations can create tiny fissures, which may expand over time if not addressed.

Common Types of Windshield Damage

Understanding the types of damage your windshield can sustain is crucial for addressing them promptly. The most common forms include:

- Cracks: These can range from small surface cracks to larger ones that compromise the structural integrity of the windshield. The longer you wait to repair a crack, the greater the chance it will spread.

- Chips: Often caused by flying debris, chips are small indentations that can turn into larger cracks if not professionally repaired.

- Scratches: While less severe than cracks or chips, scratches can impair your visibility, particularly in bright sunlight or at night. They can also worsen over time if left untreated.

- Pits: Pitting occurs when small rocks or other debris hit the windshield, leaving behind small dents that can grow into larger chips or cracks.

The Benefits of Prompt Windshield Repairs

While it may be tempting to procrastinate on repairing your windshield, doing so can have serious consequences. Here are some reasons why prompt repairs should be a priority for Florida drivers:

Safety First

The primary reason to prioritize windshield repairs is safety. A damaged windshield compromises your ability to see the road clearly and react quickly in case of an emergency. It also weakens the overall structure of your vehicle, putting you at risk in the event of a collision.

Save Money in the Long Run

While it may seem like an unnecessary expense, repairing your windshield promptly can actually save you money in the long run. Small chips and cracks can be fixed relatively inexpensively, but if left unaddressed, they can grow into larger issues that require a full windshield replacement.

Avoid Legal Consequences

In Florida, driving with a damaged windshield is against the law. If you are pulled over for a traffic violation or involved in an accident, you could face fines and other legal consequences if your windshield is not in proper condition.

Choosing the Right Windshield Repair Service

When it comes to repairing your windshield, it’s essential to choose a reputable and experienced service. Here are some tips to keep in mind:

- Do your research: Before selecting a repair service, do some online research to read reviews and compare prices.

- Check for certifications: Look for companies that have certified technicians and use high-quality materials for repairs.

- Inquire about warranties: A reputable repair service should offer a warranty on their work in case the damage reoccurs.

Preventing Future Windshield Damage

While Florida’s weather may be unpredictable, there are steps you can take to prevent further windshield damage. These include:

- Avoid direct sunlight: Park your car in a shaded area whenever possible to reduce exposure to UV rays.

- Be cautious on the road: Keep a safe distance from other vehicles to avoid flying debris that can cause chips and cracks.

- Replace worn wiper blades: Worn wiper blades can scratch your windshield, making it more susceptible to damage. Be sure to replace them regularly.

Conclusion

As a Florida driver, keeping your windshield in good condition should be a top priority. By understanding the science behind windshield damage, prioritizing prompt repairs, and taking preventative measures, you can ensure your safety on the road and save money in the long run. Remember to choose a reputable repair service and don’t hesitate to address any issues with your windshield as soon as they arise. Stay safe out there!

-

News3 months ago

News3 months agoWhat Are the Biggest Challenges in Marine Construction Projects in Australia?

-

Health4 months ago

Health4 months agoUnderstanding Ftmç: Gender-Affirming Surgery

-

Fashion3 months ago

Fashion3 months agoAttractive Beach Dresses: Elevate Your Look with These Ideas

-

Tech3 months ago

Tech3 months agoAiyifan: Unveiling the Genie of Technological Revolution

-

Business3 months ago

Business3 months agoHow Professional Concrete Cleaning Wins Repeat Business

-

Tech4 months ago

Tech4 months agoThe Ultimate Guide to the Geekzilla Podcast: Diving into the Heart of Geekdom

-

Pets2 months ago

Pets2 months agoPawsitively Perfect: The Types of Dog Harness Bundle for Your Furry Friend

-

Health3 months ago

Health3 months agoDesk Job Dilemma: Tips for Back Pain Relief