Business

Demystifying INDEXSP: .INX – Your Ultimate Guide

For investors and market analysts, navigating the stock market can be akin to exploring a complex universe with its own set of constellations. One of the most prominent stars in this financial galaxy is the S&P 500 Index, often referred to by its ticker symbol, INDEXSP: .INX. If you’re looking to demystify what this enigmatic series of letters and numbers stands for and how it influences the financial world, you’re about to embark on a comprehensive tour.

This extensive exploration will dissect everything from the basic structure of INDEXSP: .INX to the intricate reasons why investors track it with such fervor. We’ll also investigate why understanding this key index is crucial for building a robust investment framework and uncover the wealth of information it offers to those who truly grasp its significance.

Buckle up as we unravel the layers of the S&P 500 Index, and emerge not only with an intricate comprehension of how it shapes investment strategies but also with actionable insights to fortify your financial ventures.

The Beginning of Wisdom: Introduction to INDEXSP: .INX

The very format of INDEXSP: .INX can be perplexing for anyone venturing into the terrain of stocks and shares for the first time. Yet, it holds a profound meaning for thousands of investors and financial professionals who watch it with eagle eyes. To demystify this symbol, we’ll first deconstruct it and then illustrate how it encapsulates the heart of the S&P 500, the benchmark many consider the pulse of the US economy.

Unveiling INDEXSP: .INX

The ticker symbol INDEXSP: .INX is the shorthand representation of the Standard & Poor’s 500 Index. This powerhouse index includes 500 large-cap companies that are publicly traded in the United States. Unlike conventional stocks that represent an individual company’s performance, the S&P 500 paints a bigger picture of the collective health of the stock market through its diverse array of components.

Significance of the S&P 500 Index

One can hardly overstate the importance of the S&P 500 as a barometer for the stock market and American business at large. Not only does it reflect the stock market’s performance, but it also mirrors changes in the economic landscape as a whole. Given its breadth across industries and geographical locations, the S&P 500 is a reliable yardstick for investors looking to measure their portfolio’s performance and scout for promising opportunities.

Understanding INDEXSP: .INX — The Roadmap to Financial Health

Mastering the S&P 500 requires more than just recognizing its ticker symbol; it necessitates an in-depth understanding of how to interpret the wealth of data it provides and the context that surrounds it.

INDEXSP – An Index, Not a Stock

INDEXSP is a universal marker that signifies an index, not a single stock’s unique identifier. It serves as the gateway to a collection of stocks, representing sectoral and market trends, unlike any individual security. This distinction is essential in comprehending its nuances and the assorted signals it can offer to observers.

Where is INDEXSP: .INX traded?

A common query among those new to finance is where they can trade INDEXSP: .INX. The short answer is, you cannot. The S&P 500 itself is not a tradable entity; rather, it is a reference point for numerous derivative instruments and serves as a benchmark against which fund managers and analysts evaluate performance. This clarity is pivotal, as understanding what the S&P 500 is not can be as illuminative as understanding what it is.

Deciphering .INX

The ‘.INX’ portion of the symbol uniquely designates the S&P 500 among a multitude of other indices. It lays claim to a different class of stocks with different weightings and methodologies, each with its own story to tell about the market.

A Benchmark Beyond Borders

While the S&P 500 is rooted in the United States, its impact transcends geography. Investors and analysts worldwide look to its performance for signals on the trajectory of the global economy, particularly its largest players.

Extracting Information from Quotes — The Market’s Alphabet

A stock quote for INDEXSP: .INX is not merely a trivia item for stock nerds; it’s a repository of critical data that fuels investment decisions on a daily basis. We’ll walk through various facets of INDEXSP: .INX quotes and discern the value each data point holds.

The Anatomy of an INDEXSP: .INX Quote

Every quote for the S&P 500 provides raw data that, when interpreted correctly, can reveal insights into the market’s movements and potential future conditions. We’ll explore components of an INDEXSP: .INX quote, such as real-time price, daily change, previous close, and the day’s high and low, each a puzzle piece that, when combined, creates a bigger picture of market movements and investor sentiments.

The Pulse of the Market

The real-time price gives investors an immediate snapshot of the S&P 500’s value at any given moment. By keeping an eye on this figure, traders remain informed on exactly where the market stands, allowing them to adjust investment strategies accordingly.

The Daily EKG

Daily changes in an INDEXSP: .INX quote, expressed as both a percentage and points, reflect the market’s daily movements compared to its previous state. These changes signify not only the market’s fluidity but also the reaction of investors to economic and corporate developments.

Past as Prologue

The previous close details the S&P 500’s value at the end of the previous trading session, a critical reference point that can contextualize the present-day’s market dynamics in light of prior events.

Day’s Range

The high and low of the day highlight the extent of the S&P 500’s fluctuations, offering insight into the market’s volatility and the magnitude of the day’s trading activity, which can hint at investor confidence and the potential for future shifts.

Intel Into the Market Mind

News and analysis within an INDEXSP: .INX quote expand beyond the numerical to provide qualitative context and fundamentals influencing market trends. By keeping abreast of these stories, investors place themselves in an informed position to predict movements and seize opportunities.

Benefits of Tracking INDEXSP: .INX — More than Just Numbers

The S&P 500 is more than mere arithmetic; it’s a collection of directions guiding investors toward confident decisions and actionable insights that can shape robust investment strategies.

The Why behind the Watch

Unpacking the reasons behind monitoring the S&P 500 unveils the index as a vital tool in any investor’s arsenal. Whether to gauge general market performance, inform investment decisions, or scrutinize the health of individual stocks, its benefits are multifaceted.

The Index as Oracle

Watching the S&P 500 is akin to listening to a market oracle predicting economic tides. By understanding its patterns and anticipating its movements, investors gain the upper hand in foreseeing potential market shifts, successively aligning their portfolios with coming waves.

Informed Investing, Guided by the Greats

The S&P 500’s status as a preferred benchmark among industry giants solidifies its reputation as a trusted compass by which to steer investment strategies. Its regular consultation by the Warren Buffetts and Ray Dalios of the world is a testament to its power as a predictor and guide in the realm of finance.

Beyond the Basics of INDEXSP: .INX — Navigating Complexities

In our voyage through the world of S&P 500 and INDEXSP: .INX, we’ve touched upon the fundamentals. Now, it’s time to explore deeper waters, understanding the composition of the S&P 500, its weighting methodology, and the currents of historical performance.

The Movers and Shakers

Investigating the companies that compose the S&P 500 reveals the engine’s components driving its overall performance. By recognizing which sectors and corporations wield the most influence, investors can adjust their strategies with precision.

Weighting the Wealth

The way companies are weighted in the S&P 500 can significantly affect the index’s movements. Understanding this methodology illuminates why certain stocks pull more weight and how that translates into market shifts and investment opportunities.

Telling Tales of Yesteryear

Historical performance of the S&P 500 is more than an academic exercise; it’s a reflection on economic and investment trends that can be scrutinized for patterns, predictors, and parallels to present conditions. By analyzing past data, investors can glean valuable foresight for crafting astute strategies.

YOU MAY ALSO LIKE

The Power of Capital Injection Monievest in Sustaining the Business Ecosystem

Conclusion — The Legacy of the S&P 500

The S&P 500 Index, encapsulated by the enigmatic INDEXSP: .INX, is a monumental pillar in the temple of finance. Its implications are profound, its influence far-reaching. By understanding the significance of this ticker symbol and the wealth of data it unveils, investors and market analysts can strengthen their footing in the mercurial landscape of the stock market.

This understanding is not a passive accolade to be hung in the halls of finance; it is an active tool in the hands of those who wish to carve out success in the competitive market quarters. By leveraging the insights provided in this guide, you stand on the cusp of a more prosperous chapter in your financial odyssey. With the S&P 500 at your back, there is little you cannot foretell and achieve.

To continue your education on the S&P 500 and the intricacies of index investments, seek out further resources and invest in your knowledge. Remember, the index is not an end in itself but a pointer to a broader reality, an invitation to dig deeper and uncover the treasures of understanding that await those willing to explore.

The stock market is a dynamic ecosystem, pulsating with potential. Armed with the insight and information provided here, you are poised to not only survive but thrive in a domain where knowledge truly equals power. The S&P 500 and its ticker symbol, INDEXSP: .INX, are not mere symbols; they are keys to unlock the doors of wisdom and wealth. Open them with care, and the possibilities are as boundless as the stars in the sky.

Frequently Asked Questions (FAQs)

- What is the S&P 500?

- The S&P 500, or Standard & Poor’s 500, is a stock market index tracking the performance of 500 large companies listed on stock exchanges in the United States.

- How does the S&P 500 influence investment decisions?

- Investors use the S&P 500 as a benchmark to gauge the overall market performance, informing strategies and aligning portfolios with the market’s movements.

- Why are company weights important in the S&P 500?

- Company weights in the S&P 500 determine their impact on the index’s movements, affecting how shifts in their stock prices influence the overall index.

- How can I use the S&P 500 to predict economic trends?

- Analyzing patterns and historical performance of the S&P 500 can offer insights into potential economic shifts, aiding in forecasting market trends.

- Where can I find resources to learn more about the S&P 500?

- Financial websites, stock market analysis tools, and investment literature are valuable resources for in-depth study on the S&P 500.

Business

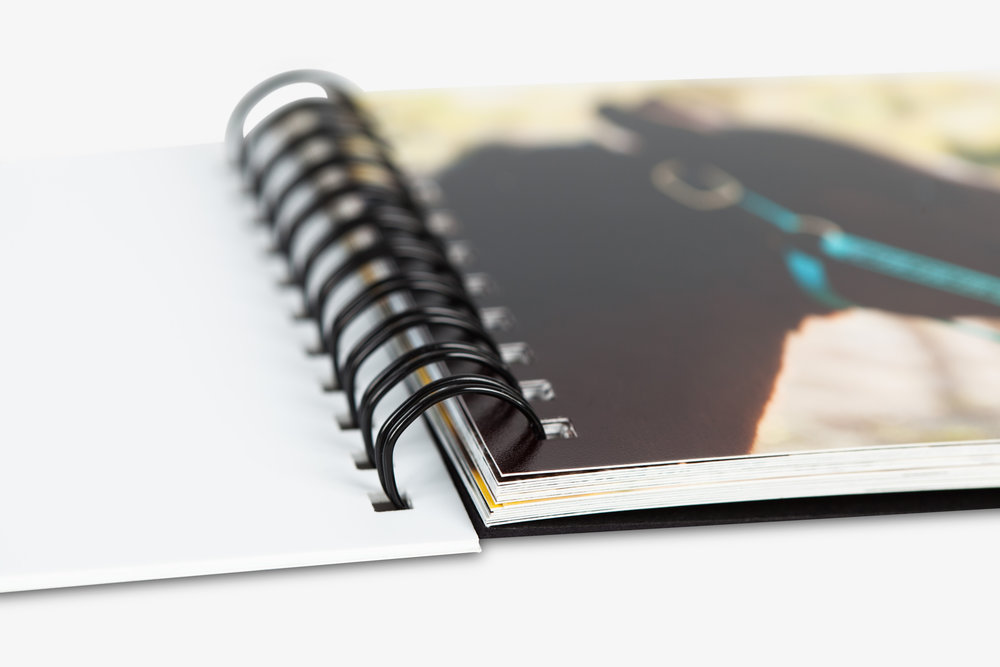

The Benefits of Choosing Spiral Bound Booklets for Your Projects

Key Takeaways

- Spiral-bound booklets offer versatility and durability.

- They are ideal for various uses, such as presentations, manuals, and portfolios.

- Understanding the process of creating spiral-bound booklets can help you make choices for your needs.

Why Choose Spiral Bound Booklets?

Spiral-bound booklets have become increasingly popular due to their practicality and versatility. Unlike other book binding methods, the spiral binding technique allows booklets to lay flat and open 360 degrees. This makes them great for various uses, from business presentations to academic projects. Additionally, if you are looking for spiral bound book printing for your next project, ensuring a high-quality finish is essential.

One of the standout features of spiral-bound booklets is their ability to lay completely flat when opened. This characteristic benefits instructional manuals and cookbooks, which users must follow hands-free. Spiral-bound booklets are among the most durable and long-lasting options available for printed materials. The spiral binding structure supports the pages, ensuring they remain intact even with frequent use, making them ideal for academic and professional settings.

Versatility and Applications

One of the main advantages of spiral-bound booklets is their versatility. They can be used for presentations, training manuals, cookbooks, portfolios, etc. For instance, many companies prefer them for creating professional handouts and reports because they are easy to handle and read. This makes them ideal for large-scale business events and more minor, more personal uses. In educational settings, spiral-bound booklets are often the go-to choice for distributing course materials, enabling students to flip through pages quickly without damaging the book.

The adaptability of spiral-bound booklets also extends to the creative industries. Artists and photographers frequently use them to create portfolios. The flexibility in size and design ensures that their work is presented in the best possible light. Additionally, small business owners often use these booklets for product catalogs, thanks to their user-friendly format, which helps in better customer engagement.

Durability and Professionalism

Regarding durability, spiral-bound booklets take a lot of work to beat. The spiral binding ensures that pages stay intact despite frequent handling, making them suitable for documents that need to endure constant use. Additionally, they lend a touch of professionalism that is often required in business settings. High-quality spiral-bound booklets not only look good but also make a lasting impression.

The reinforced spine provided by spiral binding adds another layer of durability. This means the booklets can endure rough handling, making them ideal for training manuals and educational resources that frequently use them. As highlighted in a study, such durability and professional appearance are why many educators and corporate trainers opt for spiral-bound booklets. They offer both practicality and a polished look, setting the tone for any material contained within.

Design and Customization

The customization possibilities for spiral-bound booklets are virtually endless. You can choose from various cover materials, colors, and sizes to match your needs. Whether you’re looking for a minimalist design or something more elaborate, spiral-bound booklets can be tailored to your preferences. Customization makes aligning the booklet’s design with your brand identity or personal aesthetic accessible.

For businesses, customized spiral-bound booklets can serve as an extension of your brand. Printing your company logo on the cover or using brand colors ensures that your marketing materials are cohesive and professional. Similarly, educators can design custom covers and layouts that align with their course themes, making the booklets more engaging for students. The ability to customize every aspect of the brochure means it can be as unique as its content.

Cost-effectiveness

Spiral-bound booklets are not only practical but also cost-effective. Compared to other binding methods, the production costs are generally lower while providing a high-quality finish. This makes them an excellent option for both small businesses and large corporations. The affordability of creating spiral-bound booklets keeps their quality high, making them a preferred choice for various professional uses.

The cost-effectiveness of spiral-bound booklets is particularly advantageous for bulk orders. Whether printing multiple copies for a large-scale event or producing training manuals for a new batch of employees, the lower production costs per unit can lead to significant savings. This makes spiral-bound booklets a budget-friendly option for organizations of all sizes.

How to Create Your Own Spiral Bound Booklet

Creating your spiral-bound booklet is easier than you think. Here are the steps you can follow:

- Determine the purpose and audience of your booklet.

- Choose the appropriate size and materials based on the intended use. For example, a brochure meant for a corporate presentation might require a more professional finish than one made for personal use.

- Design your content, ensuring it is well-organized and visually appealing. Use layout tools and templates to streamline the design process.

- Select a reputable printing service to produce your booklet. Ensure the service offers customization options that meet your specific needs.

- Review the proof and make any necessary adjustments before final printing. This step is crucial to ensure the final product is error-free and matches your vision.

Final Thoughts

Spiral-bound booklets are an excellent choice for a variety of projects. Their versatility, durability, affordability, and potential for customization make them a top choice for many professionals. By understanding the benefits and the process of creating spiral-bound booklets, you can make informed decisions that will enhance the quality of your printed materials.

From business presentations and training manuals to creative portfolios and personal projects, spiral-bound booklets offer a reliable and stylish way to present your content. Their ability to combine practicality with professionalism makes them a versatile tool well-suited to various applications.

Business

Top 5 Advantages Of Roll Stock Packaging

Roll stock packaging is a versatile and efficient solution that offers numerous benefits for brands looking to enhance their packaging strategies. At ePac, we specialize in providing flexible packaging solutions that cater to a wide range of industries. Here are the top five advantages of choosing roll stock packaging for your products:

Material Options

One of the key advantages of roll stock packaging is its flexibility in material options. At ePac, we offer a variety of films and laminates that can be customized to meet your specific packaging needs. Whether you require high-barrier films for perishable goods, eco-friendly options for sustainable packaging initiatives, or specialty films for unique product requirements, our rollstock packaging solutions ensure that your products are not only well-protected but also presented in a way that enhances shelf appeal and consumer perception.

Working With A Co-Packager

Partnering with a skilled co-packer can streamline your production processes and improve overall efficiency. ePac collaborates closely with brands to integrate roll stock packaging seamlessly into their operations. Whether you’re a startup looking to scale up production or an established brand seeking to optimize supply chain logistics, our expertise in flexible packaging solutions ensures that your products are packaged consistently and delivered to market with reliability and quality. Explore how our solutions, such as custom coffee bags or stick pack packaging, can elevate your brand’s packaging strategy and meet consumer demands effectively.

Business

Why Florida Drivers Should Prioritize Windshield Repair Florida

Windshield Repair Florida

Florida’s climate is known for its beautiful beaches and sunny skies, but it also poses unique challenges for vehicle owners. One of the most pressing issues? Windshield damage Repair Florida. From intense UV rays to sudden rainstorms, Florida’s weather can wreak havoc on your car’s glass.

In this blog post, we will explore the science behind windshield damage, the benefits of prompt repairs, and how you can choose the right service for your needs. We’ll also provide practical tips for preventing future damage, ensuring you stay safe on the road.

The Science Behind Windshield Damage

Florida’s weather is a double-edged sword; while it allows for year-round driving, it also subjects vehicles to conditions that can lead to windshield damage.

Florida’s Weather and Its Impact on Windshields

One of the main challenges for Florida drivers is the intense sunlight. UV rays can weaken the resin that holds your windshield together, making it more susceptible to cracks. This is especially true during the summer months when temperatures soar.

Additionally, Florida is notorious for its sudden storms. A clear day can quickly turn into a torrential downpour, causing rapid temperature changes that stress the glass. These fluctuations can create tiny fissures, which may expand over time if not addressed.

Common Types of Windshield Damage

Understanding the types of damage your windshield can sustain is crucial for addressing them promptly. The most common forms include:

- Cracks: These can range from small surface cracks to larger ones that compromise the structural integrity of the windshield. The longer you wait to repair a crack, the greater the chance it will spread.

- Chips: Often caused by flying debris, chips are small indentations that can turn into larger cracks if not professionally repaired.

- Scratches: While less severe than cracks or chips, scratches can impair your visibility, particularly in bright sunlight or at night. They can also worsen over time if left untreated.

- Pits: Pitting occurs when small rocks or other debris hit the windshield, leaving behind small dents that can grow into larger chips or cracks.

The Benefits of Prompt Windshield Repairs

While it may be tempting to procrastinate on repairing your windshield, doing so can have serious consequences. Here are some reasons why prompt repairs should be a priority for Florida drivers:

Safety First

The primary reason to prioritize windshield repairs is safety. A damaged windshield compromises your ability to see the road clearly and react quickly in case of an emergency. It also weakens the overall structure of your vehicle, putting you at risk in the event of a collision.

Save Money in the Long Run

While it may seem like an unnecessary expense, repairing your windshield promptly can actually save you money in the long run. Small chips and cracks can be fixed relatively inexpensively, but if left unaddressed, they can grow into larger issues that require a full windshield replacement.

Avoid Legal Consequences

In Florida, driving with a damaged windshield is against the law. If you are pulled over for a traffic violation or involved in an accident, you could face fines and other legal consequences if your windshield is not in proper condition.

Choosing the Right Windshield Repair Service

When it comes to repairing your windshield, it’s essential to choose a reputable and experienced service. Here are some tips to keep in mind:

- Do your research: Before selecting a repair service, do some online research to read reviews and compare prices.

- Check for certifications: Look for companies that have certified technicians and use high-quality materials for repairs.

- Inquire about warranties: A reputable repair service should offer a warranty on their work in case the damage reoccurs.

Preventing Future Windshield Damage

While Florida’s weather may be unpredictable, there are steps you can take to prevent further windshield damage. These include:

- Avoid direct sunlight: Park your car in a shaded area whenever possible to reduce exposure to UV rays.

- Be cautious on the road: Keep a safe distance from other vehicles to avoid flying debris that can cause chips and cracks.

- Replace worn wiper blades: Worn wiper blades can scratch your windshield, making it more susceptible to damage. Be sure to replace them regularly.

Conclusion

As a Florida driver, keeping your windshield in good condition should be a top priority. By understanding the science behind windshield damage, prioritizing prompt repairs, and taking preventative measures, you can ensure your safety on the road and save money in the long run. Remember to choose a reputable repair service and don’t hesitate to address any issues with your windshield as soon as they arise. Stay safe out there!

-

News3 months ago

News3 months agoWhat Are the Biggest Challenges in Marine Construction Projects in Australia?

-

Health4 months ago

Health4 months agoUnderstanding Ftmç: Gender-Affirming Surgery

-

Fashion3 months ago

Fashion3 months agoAttractive Beach Dresses: Elevate Your Look with These Ideas

-

Tech3 months ago

Tech3 months agoAiyifan: Unveiling the Genie of Technological Revolution

-

Business3 months ago

Business3 months agoHow Professional Concrete Cleaning Wins Repeat Business

-

Tech4 months ago

Tech4 months agoThe Ultimate Guide to the Geekzilla Podcast: Diving into the Heart of Geekdom

-

Pets2 months ago

Pets2 months agoPawsitively Perfect: The Types of Dog Harness Bundle for Your Furry Friend

-

Health3 months ago

Health3 months agoDesk Job Dilemma: Tips for Back Pain Relief